Silver Bullion Price

Silver Bar Price Charts. Monex silver bullion price charts feature ask prices per ounce for.999 pure silver bars. The 3-Month Live chart incorporates the latest price per ounce for the current trading day, while the 6-Month Candlestick, 1-Year Close, 5-Year Close and 10-Year Close charts show the last silver bar price. Silver bullion bars are produced in various sizes and designs, by many different Mints. The low premiums allow investors to spend their money primarily on the pure metal content. Compared to gold bars, silver bars are much more affordable. Silver Bullion for Sale While Gold remains top of mind for many investors, Silver is also a popular Precious Metal to consider based on its affordability. Silver is more accessible for a wider range of buyers, not only in price, but in the range of Silver.

Bulk Silver Deals Discount Silver Bullion. Below you will find all of our listings for items available for purchase with the perk of volume discount pricing. When it comes to bullion buying, the more you buy the more you save! All of our bulk silver deals are priced to correspond with the current spot market price. BullionVault's silver price chart shows you the real-time spot price in the professional silver bullion market. You can then purchase at those same prices using BullionVault. We give you the fastest updates online, with live data processed about every 10 seconds. There is no need to refresh your.

Monster Boxes

Monster boxes, or full mint sealed (typically 500oz) boxes of silver, are favored by customers looking to get a great price on a large quantity of silver. This is because purchasing a full monster box offers the very best discount available! Not only are we able to offer these awesome discounts on our own SilverTowne Minted items, but we also have a few different government minted items available with similar discounts. Our current government minted monster box items are American Silver Eagles, Australia Silver Kangaroos or Canadian Silver Maple Leaf coins.

Buy Silver Direct from the Mint Quality Guaranteed

Here at SilverTowne, the majority of silver bullion items offered are actually designed and produced at our very own mint! From our large selection of stamped designs to our hand-poured silver bars we are positive you'll find exactly what you need at SilverTowne. All .999 fine silver bars for sale at SilverTowne are 100% quality guaranteed! With high quality standards and a lasting industry reputation, SilverTowne has been your trusted coin and bullion dealer since 1949 and has been manufacturing our own silver bullion bars and silver rounds since 1973.

Silver Bullion Bars

Investing in silver is gaining popularity, and buying silver coins is not the only option for those looking to make an investment in silver. Silver bars are a smart way to invest in silver, for both the experienced investor who wants large quantities, as well as for the first-time investor. The multiple sizing options and low premiums make silver bars a smart way to invest in silver.

A Short History of Silver Bars

Silver bars are typically 99.9 percent pure silver that has been melted down and minted into bar form in myriad sizes. Silver bullion investors are always purchasing and selling these bars, making them one of the most popular ways to invest in physical silver.

Silver has been a monetary commodity for thousands of years, though the exact starting time period is still in debate among historians. Throughout history, it has been mined, bartered, and traded as currency. In the 20th century, silver stopped being used in legal tender. But silver’s value as a precious metal means its production as bullion continued, with people buying coins and bars for the value of silver itself rather than as currency.

Why Silver Bullion Investors Prefer Silver Bars

Some people who invest in silver feel that silver bullion bars are a better investment than silver coins, because they cost less to purchase, and they are easy to store given their uniformity. If an investor wants physical wealth, silver bars are a good way to store a large amount in a relatively small space. Investors prefer the security of physically owning assets, because they’re far safer from inflation and market crashes than paper investments are.

Investors in silver also like to collect silver bars, since different mints have different logos, and because certain editions of bars have stopped being produced, making them more valuable than just the current cost of silver.

Sizes and Mints

Silver bars come in probably the widest variety of sizes ranging from 1 gram to 1,000 ounces. With all of these options available, ten ounce bars and kilo bars are popular among investors, though you can also purchase smaller increments like 5 ounces and 1 ounce. One-thousand ounce bars exist, as well, though they’re generally too large for individuals.

Both private mints and government mints make silver bars. Some private mints known for their quality are the Sunshine Mint and SilverTowne. Mints such as the US Mint, the Royal Canadian Mint, and the British Royal Mint sell silver bullion, but only certain government mints (like the Royal Canadian Mint) sell silver bullion in the form of bars.

Pricing, Quality, and Purchasing

Silver bullion bars have a lower premium than coins in most cases, because it is cheaper to create silver bars than it is to mint coins. The larger the size of the silver bar, the lower the cost of production per ounce, since so many ounces are accounted for in a single bar. So, the larger the silver bar, the lower the premium paid per ounce.

First-time investors should be aware that sterling silver is not the purest form of silver. Almost 8 percent of sterling silver is actually copper. Silver bullion purity is denoted as .999 or .9999, meaning 99.9 percent or 99.99 percent pure. Generally, each mint is going to have its own design stamped on the bars. Along with that, the size and the purity will be stamped on the bars, as well.

When buying bars second-hand, be aware of the condition. Scratches or dents make the bar harder to resell, but that doesn’t mean all second-hand bars are in bad condition. However, second-hand bars will run much cheaper because they lack the extra costs associated with newly minted bars.

Where to Get Silver Bars

Silver bars are available from online retailers, such as ourselves, directly from private mints, physical silver and gold shops, auction sites like eBay, and in some countries directly from banks. Bars produced by certain mints are more readily available than others. Silver.com can help an investor find the correct size and mint, as well as offer introductions to previously unconsidered options. Some sizes are far more common than others, making them more readily available to purchase. Ten and 100 ounce sizes are much more common than 25 and 50.

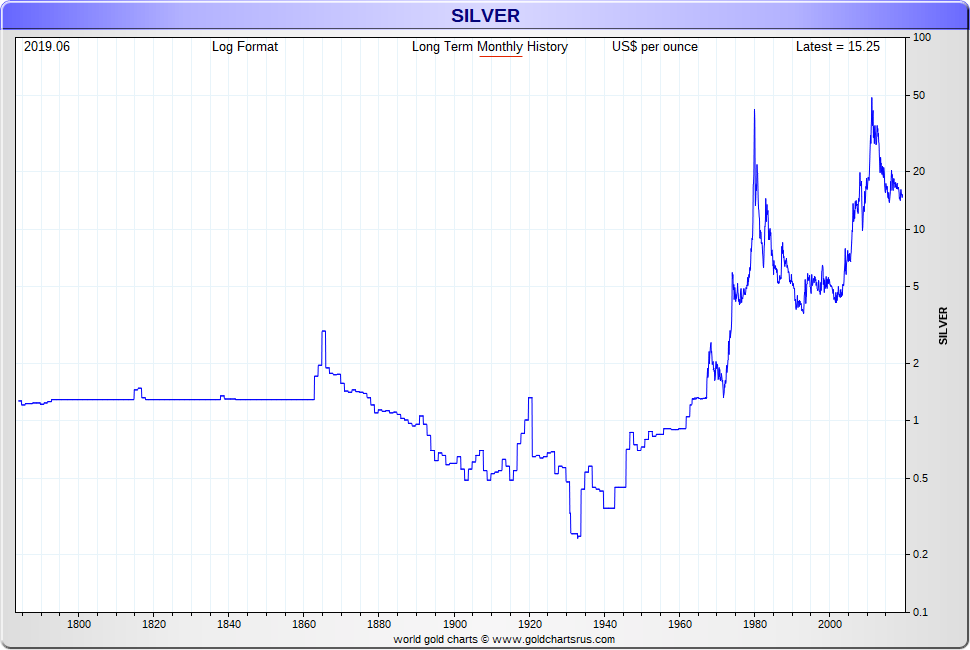

Silver Bullion Price Chart History

Start investing in silver bars today, or expand an existing silver bullion collection by purchasing silver bars from Silver.com.